| ||||||||

| ||||||||

|

Info about Fair Housing in Maryland - including housing discrimination, hate crimes, affordable housing, disabilities, segregation, mortgage lending, & others. http://www.gbchrb.org. 443.347.3701.

| ||||||||

| ||||||||

|

|

| View maps and read the full report |

|

CDC/HHS Announces |

Sillerman Center

Publishes List of Efforts to Support Housing Integration. The Sillerman

Center for the Advancement of Philanthropy at Brandeis University has published

a "landscape survey" on grassroots efforts to support housing

integration in the country, Inhabiting

Change: Roles for Philanthropy in Reducing and Redressing Housing Segregation.

(PRRAC Update, August 27, 2020)

Council on Economic

Mobility RFI About Economic Mobility for Low-Income Households. The

Department of Housing and Urban Development is a member of the Council on

Economic Mobility (Council), a new federal interagency effort. The Council

seeks to create an accountable and effective structure for interagency

collaboration and to use federal authorities to promote family-sustaining careers

and economic mobility for low-income Americans. Recently, the Council published

a request

for information (RFI) to gather feedback from all of its stakeholders. Click

here to view the RFI. Your input is important! The information gathered in

response to the RFI will be used to better inform the Council's priorities,

working group activities, stakeholder engagement, and federal programs.

Feedback on the specific economic mobility, recovery, and resilience challenges

in local communities in the short, medium, and long term is welcome. We

understand that this may be a busy time. While we encourage you to comment as

soon as possible, the RFI is open for comment until October 2, 2020. (HUD

PD&R Updates, August 25, 2020)

HUD Reaches

Conciliation Agreement Resolving National Origin Housing Discrimination The

three Conciliation Agreements with the owners and property management company

of Springdale Ridge Apartments in Springdale, Arkansas, resolves allegations

that they discriminated against several residents because of their national

origin and retaliated against an employee living on site who sought to inform

the residents of their fair housing rights. Read

the agreements. (HUD press release, August 21, 2020)

NCRC And SLEHCRA Call

On Edward Jones To Add St. Louis Assessment Area For New Banking Division.

NCRC and the St. Louis Equal Housing and Community Reinvestment Alliance

(SLEHCRA) have urged the Federal Deposit Insurance Corporation (FDIC) to

require Edward Jones Bank to meet Community Reinvestment Act (CRA) assessment

requirements in the St. Louis area. Read

more. (Just News, National Community Reinvestment Coalition, August 6,

2020)

Why Are There No Disability-Related Questions on the 2020 Census? There is still time to be counted in the 2020 Census! Visit 2020census.gov or call 884-330-2020 and be counted in the 2020 Census today. The deadline to respond is September 30, 2020. (News from NDRN, National Disability Rights Network, August 27, 2020)

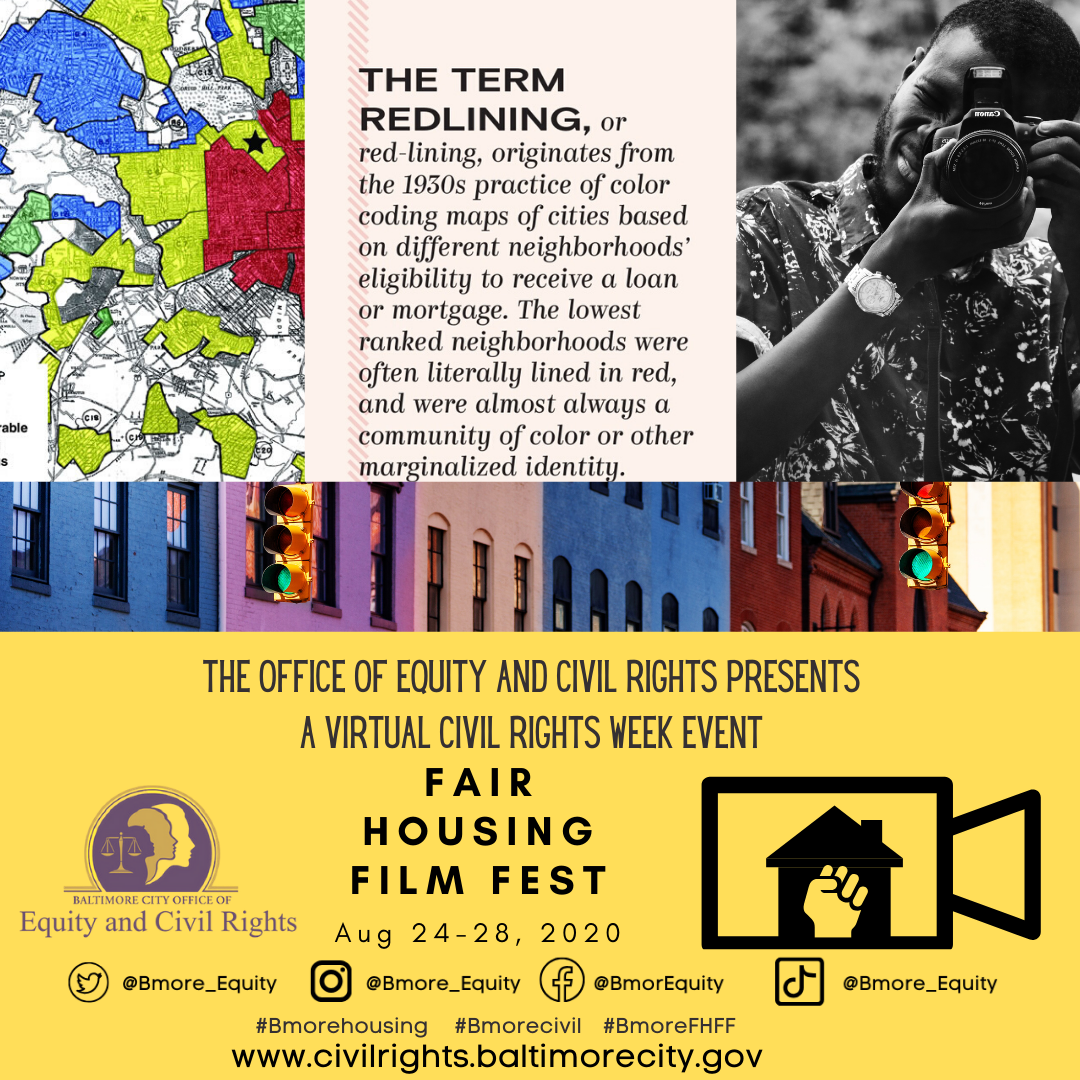

Join the Baltimore City Office of Equity and Civil Rights for this year’s Civil Rights Week, celebrated with our first annual Fair Housing Film Festival. Watch films, join panel discussions, and see original performances all based on the idea of fair housing- everyone’s right to live free from housing discrimination.

All films, panel discussions, and performances will be hosted on Eventive, check back soon for links to register or sign up today to receive more information.

Happening All Week:

Virtual Resource Fair - Check out the videos from organizations all over Baltimore City to learn more about the services they provide. http://bit.ly/VirtualResourceFair.

Student Film Festival - Watch student films and help decide who will win a cash prize for the most film with the most views. Deadline extended to 8/24! learn more at https://filmfreeway.com/FairHousingFilmFestival.

Social Media Contest - Participate in the festival by joining our social media contest, posts with the most views win a cash prize.

***